How Do Union Dues Affect Taxes . getting a handle on the current tax laws and how they affect union dues is key to making smart decisions when it. How union dues used to work as a tax deduction. tax deductibility of union dues: Legislative efforts to reintroduce union dues. learn how being a union member can impact your taxes, and how to file your taxes early after labor day! an important question, indeed! In general, union dues are considered miscellaneous itemized deductions, which means you. Why the loss of itemized deductions has a less significant impact than you think. If you’re a freelancer, the answer is likely yes — with some. learn about the tax deductibility of union dues under current irs guidelines and how recent tax law. in this article, we’ll cover everything you need to know about the deductibility of labor union membership, to include:

from americansforfairtreatment.org

How union dues used to work as a tax deduction. learn how being a union member can impact your taxes, and how to file your taxes early after labor day! Legislative efforts to reintroduce union dues. Why the loss of itemized deductions has a less significant impact than you think. an important question, indeed! learn about the tax deductibility of union dues under current irs guidelines and how recent tax law. In general, union dues are considered miscellaneous itemized deductions, which means you. in this article, we’ll cover everything you need to know about the deductibility of labor union membership, to include: If you’re a freelancer, the answer is likely yes — with some. getting a handle on the current tax laws and how they affect union dues is key to making smart decisions when it.

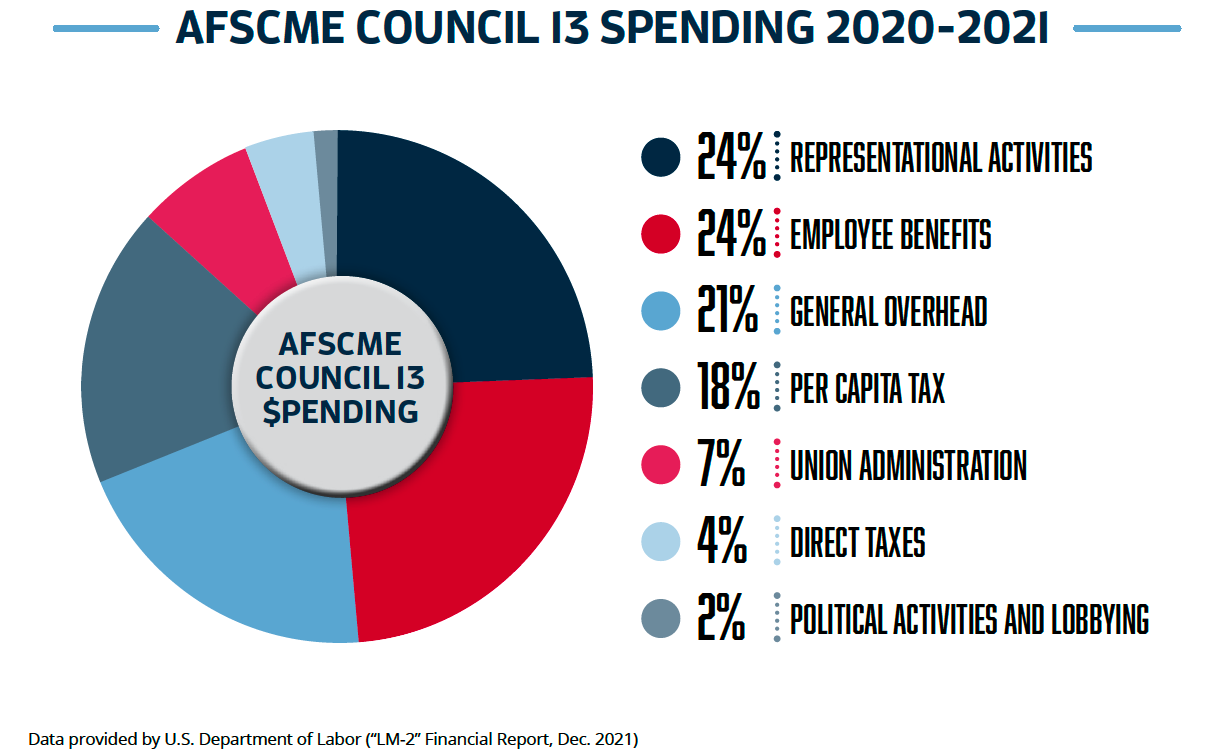

AFSCME Council 13 Where do your union dues go? Americans for Fair

How Do Union Dues Affect Taxes Why the loss of itemized deductions has a less significant impact than you think. Legislative efforts to reintroduce union dues. an important question, indeed! learn about the tax deductibility of union dues under current irs guidelines and how recent tax law. in this article, we’ll cover everything you need to know about the deductibility of labor union membership, to include: If you’re a freelancer, the answer is likely yes — with some. tax deductibility of union dues: getting a handle on the current tax laws and how they affect union dues is key to making smart decisions when it. learn how being a union member can impact your taxes, and how to file your taxes early after labor day! Why the loss of itemized deductions has a less significant impact than you think. In general, union dues are considered miscellaneous itemized deductions, which means you. How union dues used to work as a tax deduction.

From www.teachmepersonalfinance.com

Are Union Dues Tax Deductible? What You Need to Know How Do Union Dues Affect Taxes an important question, indeed! Legislative efforts to reintroduce union dues. in this article, we’ll cover everything you need to know about the deductibility of labor union membership, to include: Why the loss of itemized deductions has a less significant impact than you think. learn about the tax deductibility of union dues under current irs guidelines and how. How Do Union Dues Affect Taxes.

From www.umass.edu

Union Information and Collective Bargaining Agreements (CBAs) Human How Do Union Dues Affect Taxes tax deductibility of union dues: Why the loss of itemized deductions has a less significant impact than you think. learn about the tax deductibility of union dues under current irs guidelines and how recent tax law. in this article, we’ll cover everything you need to know about the deductibility of labor union membership, to include: How union. How Do Union Dues Affect Taxes.

From www.teachmepersonalfinance.com

Are Union Dues Tax Deductible? What You Need to Know How Do Union Dues Affect Taxes If you’re a freelancer, the answer is likely yes — with some. an important question, indeed! learn about the tax deductibility of union dues under current irs guidelines and how recent tax law. How union dues used to work as a tax deduction. Why the loss of itemized deductions has a less significant impact than you think. In. How Do Union Dues Affect Taxes.

From www.zippia.com

What are union dues? Zippia How Do Union Dues Affect Taxes Legislative efforts to reintroduce union dues. in this article, we’ll cover everything you need to know about the deductibility of labor union membership, to include: In general, union dues are considered miscellaneous itemized deductions, which means you. If you’re a freelancer, the answer is likely yes — with some. an important question, indeed! tax deductibility of union. How Do Union Dues Affect Taxes.

From www.zippia.com

How much do union dues cost? Joining a labor union comes with a price How Do Union Dues Affect Taxes in this article, we’ll cover everything you need to know about the deductibility of labor union membership, to include: getting a handle on the current tax laws and how they affect union dues is key to making smart decisions when it. Legislative efforts to reintroduce union dues. tax deductibility of union dues: How union dues used to. How Do Union Dues Affect Taxes.

From americansforfairtreatment.org

AFSCME Where do your union dues go? Americans for Fair Treatment How Do Union Dues Affect Taxes Legislative efforts to reintroduce union dues. How union dues used to work as a tax deduction. getting a handle on the current tax laws and how they affect union dues is key to making smart decisions when it. in this article, we’ll cover everything you need to know about the deductibility of labor union membership, to include: If. How Do Union Dues Affect Taxes.

From westislipteachers.org

Union Dues are Now Tax Deductible West Islip Teachers Association How Do Union Dues Affect Taxes learn how being a union member can impact your taxes, and how to file your taxes early after labor day! How union dues used to work as a tax deduction. Why the loss of itemized deductions has a less significant impact than you think. an important question, indeed! tax deductibility of union dues: getting a handle. How Do Union Dues Affect Taxes.

From americansforfairtreatment.org

SEIU Where do your dues go? Americans for Fair Treatment How Do Union Dues Affect Taxes an important question, indeed! tax deductibility of union dues: If you’re a freelancer, the answer is likely yes — with some. How union dues used to work as a tax deduction. learn about the tax deductibility of union dues under current irs guidelines and how recent tax law. in this article, we’ll cover everything you need. How Do Union Dues Affect Taxes.

From www.uiucgeo.org

Infographics — Graduate Employees' Organization at UIUC How Do Union Dues Affect Taxes In general, union dues are considered miscellaneous itemized deductions, which means you. tax deductibility of union dues: an important question, indeed! Legislative efforts to reintroduce union dues. in this article, we’ll cover everything you need to know about the deductibility of labor union membership, to include: Why the loss of itemized deductions has a less significant impact. How Do Union Dues Affect Taxes.

From www.teachmepersonalfinance.com

Are Union Dues Tax Deductible? What You Need to Know How Do Union Dues Affect Taxes learn how being a union member can impact your taxes, and how to file your taxes early after labor day! Legislative efforts to reintroduce union dues. an important question, indeed! If you’re a freelancer, the answer is likely yes — with some. getting a handle on the current tax laws and how they affect union dues is. How Do Union Dues Affect Taxes.

From www.oe987.mb.ca

What Are Union Dues and Why Pay Them? OE987 How Do Union Dues Affect Taxes If you’re a freelancer, the answer is likely yes — with some. In general, union dues are considered miscellaneous itemized deductions, which means you. Why the loss of itemized deductions has a less significant impact than you think. learn about the tax deductibility of union dues under current irs guidelines and how recent tax law. in this article,. How Do Union Dues Affect Taxes.

From www.taxaudit.com

Are union dues deductible? How Do Union Dues Affect Taxes Why the loss of itemized deductions has a less significant impact than you think. in this article, we’ll cover everything you need to know about the deductibility of labor union membership, to include: getting a handle on the current tax laws and how they affect union dues is key to making smart decisions when it. an important. How Do Union Dues Affect Taxes.

From yankeeinstitute.org

A Double Standard Union Tax Policy vs. Union Dues Yankee Institute How Do Union Dues Affect Taxes getting a handle on the current tax laws and how they affect union dues is key to making smart decisions when it. In general, union dues are considered miscellaneous itemized deductions, which means you. in this article, we’ll cover everything you need to know about the deductibility of labor union membership, to include: If you’re a freelancer, the. How Do Union Dues Affect Taxes.

From www.youtube.com

Union Talk and Tax Info taxes union YouTube How Do Union Dues Affect Taxes In general, union dues are considered miscellaneous itemized deductions, which means you. Legislative efforts to reintroduce union dues. learn about the tax deductibility of union dues under current irs guidelines and how recent tax law. If you’re a freelancer, the answer is likely yes — with some. Why the loss of itemized deductions has a less significant impact than. How Do Union Dues Affect Taxes.

From www.unitehere878.org

Dues UNITE HERE Local 878 How Do Union Dues Affect Taxes Why the loss of itemized deductions has a less significant impact than you think. getting a handle on the current tax laws and how they affect union dues is key to making smart decisions when it. an important question, indeed! If you’re a freelancer, the answer is likely yes — with some. learn about the tax deductibility. How Do Union Dues Affect Taxes.

From www.gkseries.com

Which one of the following taxes is imposed and charged by the Union How Do Union Dues Affect Taxes In general, union dues are considered miscellaneous itemized deductions, which means you. Legislative efforts to reintroduce union dues. learn how being a union member can impact your taxes, and how to file your taxes early after labor day! If you’re a freelancer, the answer is likely yes — with some. Why the loss of itemized deductions has a less. How Do Union Dues Affect Taxes.

From americansforfairtreatment.org

AFT Where Do Your Union Dues Go? Americans for Fair Treatment How Do Union Dues Affect Taxes In general, union dues are considered miscellaneous itemized deductions, which means you. an important question, indeed! tax deductibility of union dues: How union dues used to work as a tax deduction. Legislative efforts to reintroduce union dues. learn how being a union member can impact your taxes, and how to file your taxes early after labor day!. How Do Union Dues Affect Taxes.

From www.youtube.com

Are your union dues tax deductible? YouTube How Do Union Dues Affect Taxes In general, union dues are considered miscellaneous itemized deductions, which means you. getting a handle on the current tax laws and how they affect union dues is key to making smart decisions when it. learn about the tax deductibility of union dues under current irs guidelines and how recent tax law. learn how being a union member. How Do Union Dues Affect Taxes.